About Interest Rates

Playing the Waiting Game on Interest Rates

This practice may cost Home Buyers (first time and move-up) more than they think…

“The sooner, the better” may be the best strategy for buying houses. That’s because lower interest rates can actually mean higher costs for those who delay the purchase of a home too long.

When there are fluctuations in mortgage rates, Americans have a habit of waiting just a little while longer, hoping to save thousands of dollars as the rates dip lower. But, even if the rates do fall further, that waiting strategy, says a housing expert, can actually cost you more.

John Pfister, vice president of Market Research at Novare Title Company, says home buyers tend to forget that as mortgage rates drop, housing prices tend to begin rising.

“Very often, the savings projected by lower interest rates are more than offset by the simultaneous rise in home prices,” adds Pfister.

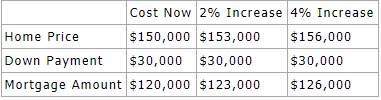

To illustrate the point, here’s an example of what might typically happen:

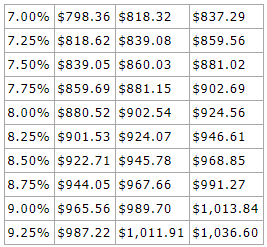

A $150,000 house is purchased with a down payment of $30,000 and the balance is financed at a fixed 8.75 percent rate over 30 years. Monthly principal and interest payments come to $944.05.

If the buyer chooses to wait until interest rates drop to 8.50 percent and, in the meantime the cost of the house climbs a modest 2 percent, which is a common increase in an interest-driven market, the monthly payment would rise to $945.78.

Payment differences between a 9.25 percent rate and rates a quarter percent lower down to 7 percent are shown in the following table based on housing price increases of 2 and 4 percent.

At Novare Title, Pfister tracks housing statistics from coast to coast. His research shows that the cost of financing a home has outrun housing inflation in only three of the last 20 years. The 20-year average increase in housing inflation is 7.4 percent; for the cost of the money, it is a mere 1.4 percent.

Here’s an Example